In 2017, I attended Phase 1 of the New Frontiers Programme which is run by Enterprise Ireland. The programme ran two nights a week over six weeks. There was no fee to attend. I would highly recommend this programme to anyone starting a new enterprise, whether your idea is just an idea or is a semi-developed product. What follows is a post which gives an outline of night 10 of the course. When fully published, there will be 11 posts documenting all nights of Phase 1. To see a list of published posts, click here.

Tonight’s topic was always going to be a tough one as it is an area where I am very weak. Luckily the facilitator was full of energy and deliver the content in an engaging way. Tonight’s facilitator was Gail McEvoy of McEvoy Craig in Drogheda.

There was an interesting point made right at the start, 97% of Irish employment is through small and medium enterprises. With that in mind, no two small firms are the same so direct advice should be sought as opposed to copying second-hand advice. In the first half of the evening, Gail spoke about the differences between acting as a sole trader, a partnership or as a limited company. I did not make notes on the partnership section as it is not relevant to BookingHawk.com

Sole Trader

Apparently moving from sole trader to limited company is relatively straightforward. Although moving the opposite direction is not as straightforward, it is still possible.

- Your business is not a separate legal entity

- You are not eligible for as many tax reliefs

- All money going into your account is eligible for income tax at year end

- Enterprise Ireland do not award grants to Sole Traders

- Registering for VAT is optional as long as your turnover is less than €37,500. However, not registering for VAT means that I cannot claim VAT back on purchases made.

- From the latest companies act, turnover is defined as:

-

“turnover”, in relation to a company, means the amounts of revenue derived from the provision of goods and services falling within the company’s ordinary activities, after deduction of—(a) trade discounts,(b) value-added tax, and(c) any other taxes based on the amounts so derived

-

Limited Company

- Separate legal entity

- Bigger scope for pension investment

- Easy to issue shares

- Setup will cost approximately €500 and it is best to get an accountant to do it

- Even if you have a business bank account whilst acting as a sole trader, you need a new one for your limited company.

- It is advisable to have two business bank accounts so that you may syphon off any VAT and PRSI contributions to the second account as they are due.

- It will cost approximately €1000 – €1500 per year to get your accountant to do the accounts and p60’s etc for your limited company. This figure is a very rough educated guess based on having no knowledge of the company.

- A director and a secretary are required to setup a limited company

- A director is highly responsible and must sign declarations that the accounts are correct, therefore a good accountant is essential.

- A director must act in the best interests of members (shareholders) and employees as opposed to the previous modus operandi whereby they had to act in the best interests of the company.

- Any loans given to/from the company by the director must be documented or else it is just a donation to the company.

- A director should be paid a salary from the company.

- Any money taken out of the company will be subject to 12.5% corporation tax (this will not include salaries)

Financial Management

In the second half of the evening, Gail talked about Financial Management. She stressed that all companies would be successful if they followed the following four steps in a cyclical way (eg, going back to step 1 after step 4 and repeating)

- Plan

- Budget

- Measure KPI’s

- React

Gail stated how a business plan consists of four main areas,

- Cash Flow

- Profit & Loss

- Balance Sheet

- Assumptions

It is important to record assumptions as they will help to decipher how your figures came about if looking back over business plans. Gail then led some exercises around calculating break even and recording cash flow projections. I am sure all of this is basic junior certificate stuff for anyone that has done accounting/economics in secondary school but it was all new to me, and very interesting.

Attracting Investors

Gail talked about the tax incentives that exist around starting up new businesses and attracting investment. She stressed that the parameters of these incentives are always changing and will continue to do so as Brexit unfolds. Two schemes, in particular, were mentioned.

EII Scheme

Essentially, this will allow a high earning investor to invest €150,000 into your business and it will only cost them €120,000.

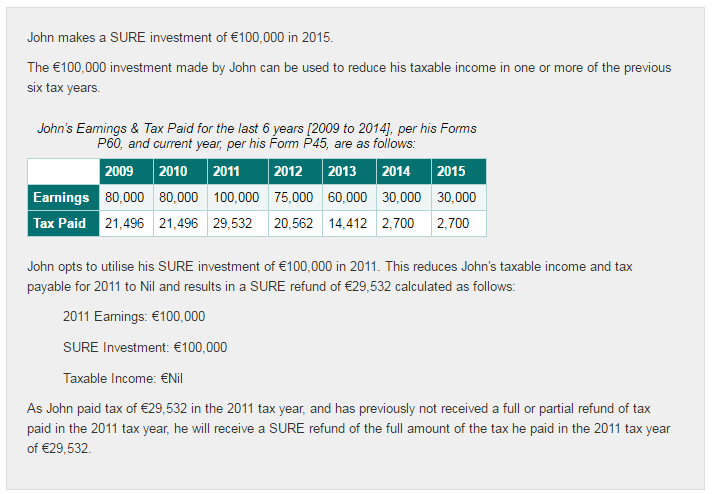

SURE Scheme

This gives you a tax refund from the last six years to invest in your company. See the below info-graphic.

Other Points Of Interest From The Night

The night consisted of a lot of Q&A which was very interesting. Some points that I made a note of that arose during these conversations include the following. cro.ie can be a good place to see the limited version of any limited companies (your competitors) accounts. Search4Less.ie can be a useful tool if that is of interest to you. BrightPay.ie is a useful and reasonable priced payroll software tool costing about €170 per year. Leaflet IT53 and Leaflet IT54 may be useful when operating as a limited company director for claiming mileage expenses etc.

Typical mistakes Gail sees startups make in Ireland are:

- Getting so bogged down in the day to day running of the company that you ignore the figures and by the time you realise there is a problem it is too late. This is why having regular contact with a bookkeeper is advisable. A bookkeeper is cheaper than an accountant and will help you with the ‘Plan, Budget, Measure KPI’s, React’ cycle.

- Ignoring the benefits available to startups. Many people invest money in their business after paying income tax on it. With the advice of a good accountant, it can be ensured that you only pay the tax you are liable for.

Conclusion

The final learning night of the Phase 1 programme was typically full of great information. It is now clear to me that I need to invest in the services of a good accountant.

Read Night 2 – Idea Exploration and Creative Thinking

Read Night 3 – Market Opportunity Problem / Pain ID

Read Night 4 – Market Analysis / Customer Identification

Read Night 5 – Route To Market

Read Night 6 – Lean Business Model Canvas

Read Night 7 – Marketing Communications

Read Night 9 – Business Case Document and Team Makeup

Read Nights 11 & 12 – Presenting The Case

BookingHawk.com is an ideal diary and booking system for small business. If you know someone that would benefit from an online booking system, please let me know about them. I will send you a two paragraph email for you to forward to your friend so it couldn’t be less hassle for you to help a couple of Irish businesses to grow!